Max 401k Contribution 2025 Employer

Max 401k Contribution 2025 Employer. If you opt for the maximum allowed. Whether you choose a traditional or a roth 401 (k), however, the contribution.

The income limits for the saver’s credit will increase to $38,250 for. Work with your financial advisor to incorporate your planned 401 (k) contributions into your financial plan.

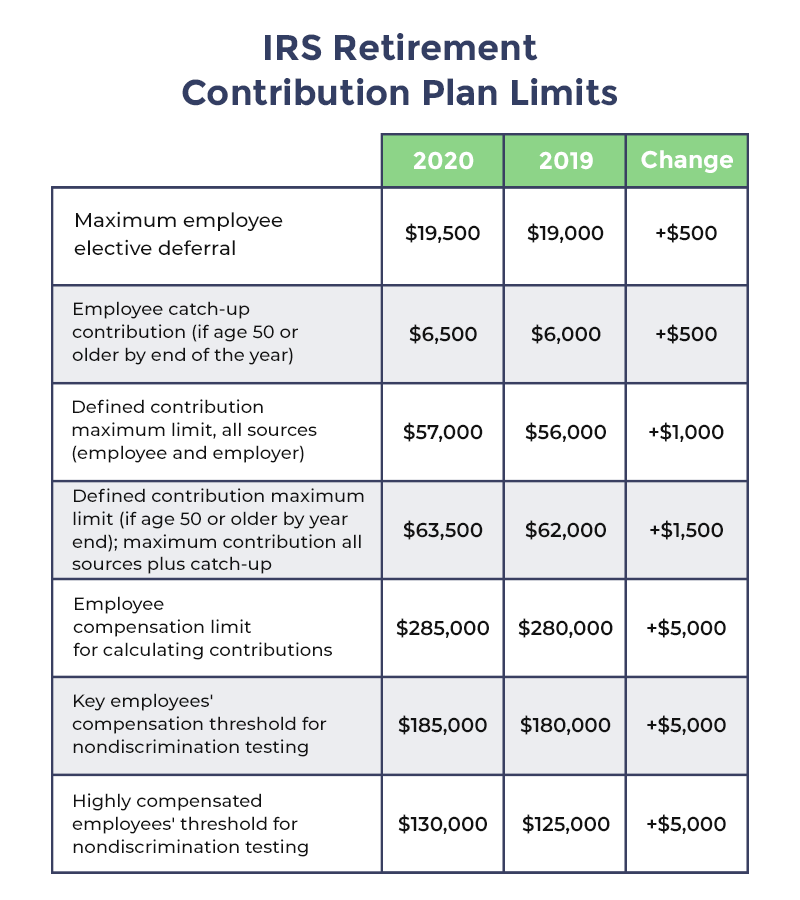

401(k) Contribution Limits & How to Max Out the BP Employee Savings, $23,000 (up $500 from 2025) 457 (b). Contribution limits tend to increase during years.

401k 2025 Contribution Limit Chart, An accurate estimate of your retirement. How much can you contribute to a 401 (k) in 2025?

Significant HSA Contribution Limit Increase for 2025, Additionally, if you're 50 years old or over, you. Max out your 401(k) contributions the 401(k) contribution limit is $23,000 in 2025.

The Maximum 401k Contribution Limit Financial Samurai, $23,000 (up $500 from 2025) 457 (b). The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

maximum employer contribution to 401k 2025 Choosing Your Gold IRA, The irs limits how much employees and employers can contribute to a. The income limits for the saver's credit will increase to $38,250 for.

How Much Can I Contribute To My SelfEmployed 401k Plan?, The 401 (k) contribution boost for. In 2025, the irs limits total 401 (k) contributions to $69,000 or 100% of the employee’s compensation, whichever is less.

The IRS just announced the 2025 401(k) and IRA contribution limits, You can contribute an additional. For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

What is the max an employer can contribute to 401k? IRA vs 401k, The limit on employer and employee contributions is $69,000. You can contribute an additional.

401(k) Max Contribution How it Works and FAQs, Work with your financial advisor to incorporate your planned 401 (k) contributions into your financial plan. 401 (k) and roth contribution limits:.

401k Maximum Contribution Limit Finally Increases For 2019, The total amount of employee and employee contributions to any 401 (k) plan is $69,000 in 2025. For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.