Paycheck Tax Calculator California 2025

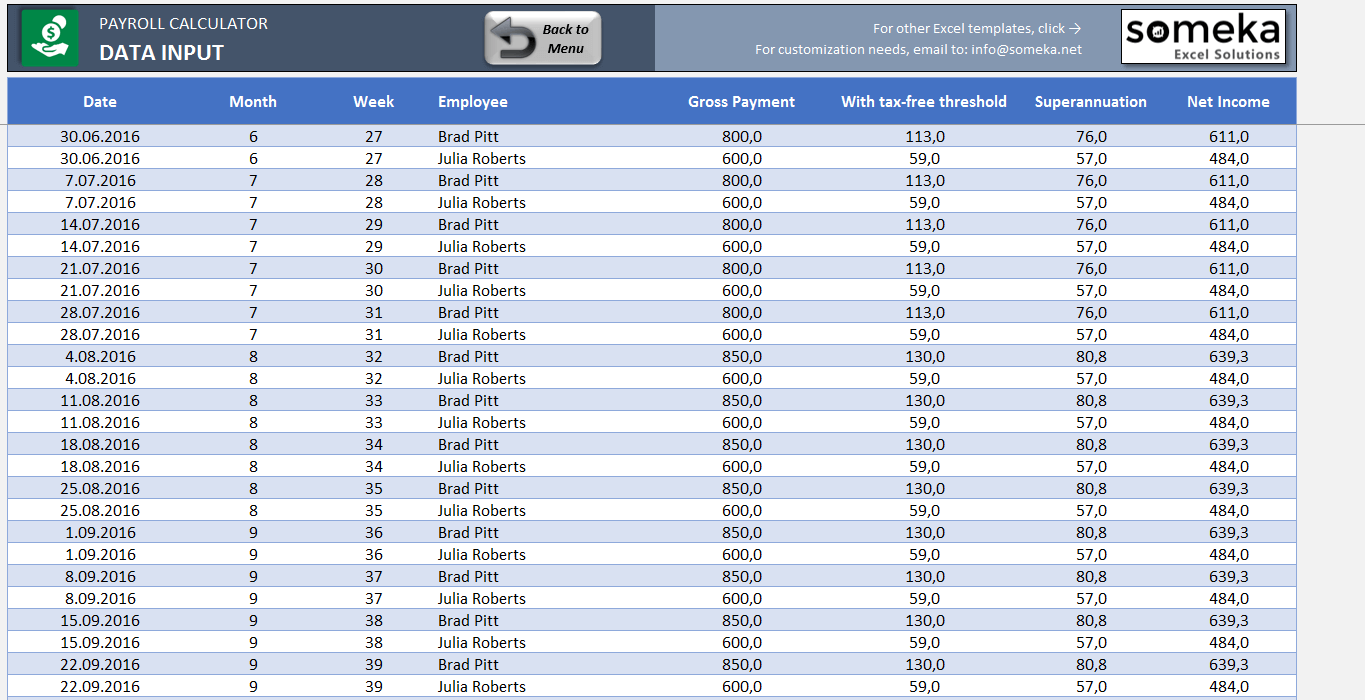

Paycheck Tax Calculator California 2025. Updated for 2025 with income tax and social security deductables. Use our income tax calculator to find out what your take home pay will be in california for the tax year.

Calculated using the california state tax tables and allowances for 2025 by selecting your filing status and entering your income for. Use our income tax calculator to find out what your take home pay will be in california for the tax year.

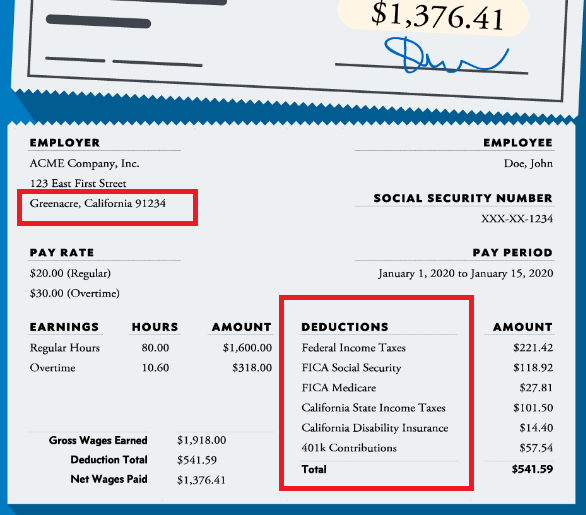

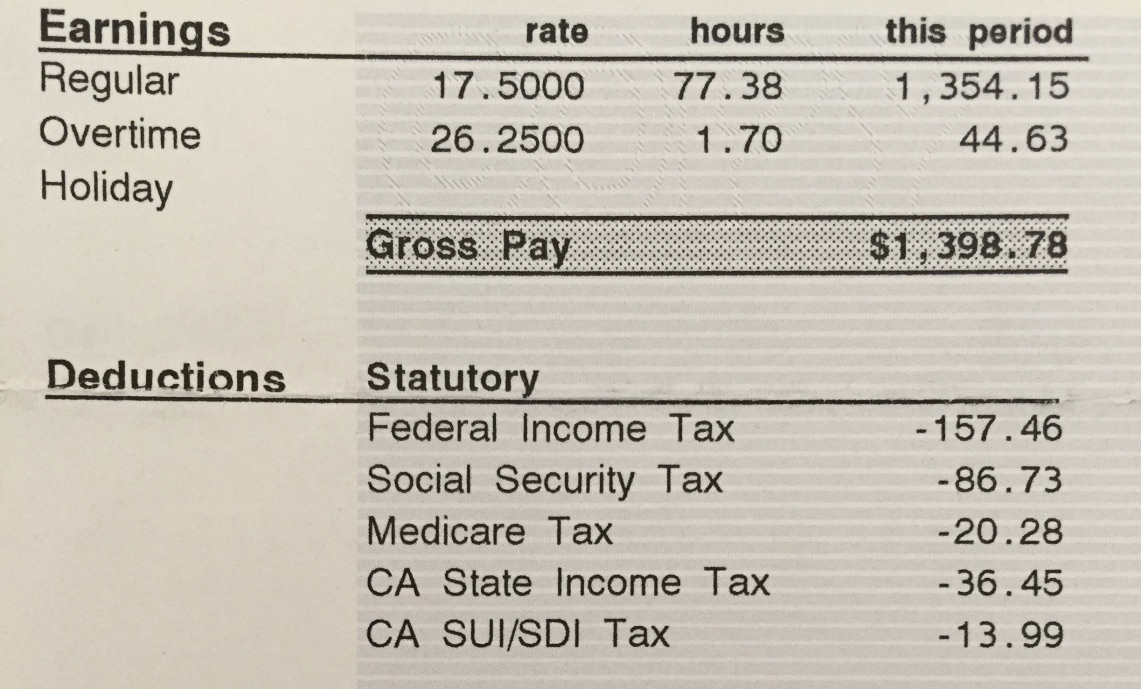

How much are paycheck tax deductions in California? Unemployment Gov, If you make $55,000 a year living in the region of california, usa, you will be taxed $11,676. Smartasset's california paycheck calculator shows your hourly and salary income after federal, state and local taxes.

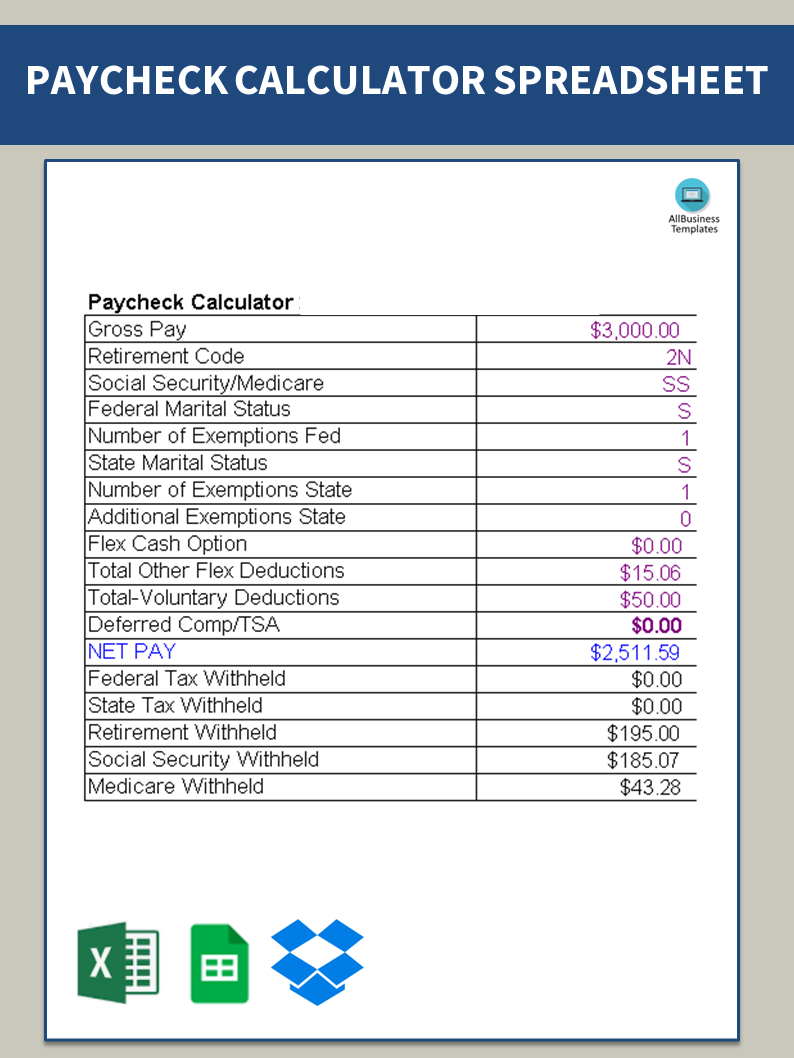

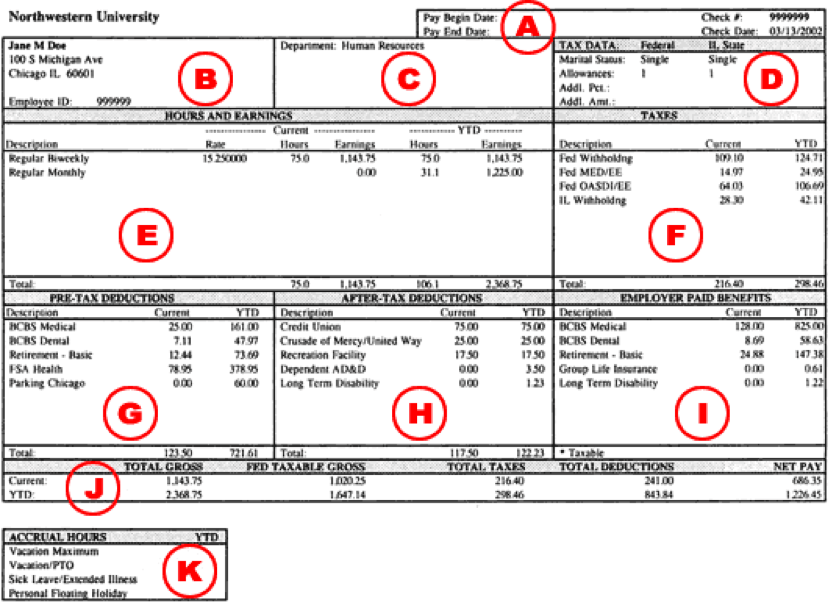

Figure payroll taxes calculator, Determine if state income tax and other state and local taxes and withholdings apply. The salary tax calculator for california income tax calculations.

Paycheck Tax Withholding Calculator Tax Withholding Estimator 2025, That means that your net pay will be $43,324 per year, or $3,610 per month. Enter your info to see your take home pay.

Quebec Paycheck Calculator TaxTips.ca Canadian Tax & RRSP Savings, Enter your gross salary, pay frequency, and other relevant details to calculate your net income after all state and federal taxes. If you earn $55,000 a year living in the region of california, usa, you will be taxed $11,676.

Gratis Paycheck Calculator, California paycheck calculator for salary & hourly payment 2025 curious to know how much taxes and other deductions will reduce your paycheck? The paycheck calculator below allows employees to see how these changes affect pay and withholding.

How To Calculate Paycheck After Taxes In California Tax Walls, The 2025 california state income tax rates range. California state income tax calculation:

Free California Paycheck Calculator 2025, Updated for 2025 with income tax and social security deductables. We’ll do the math for you—all you need to.

Free payroll tax, paycheck calculator YouTube, The paycheck calculator below allows employees to see how these changes affect pay and withholding. To effectively use the california paycheck.

50 Shocking Facts Unveiling Federal Tax Deductions from Paychecks 2025, The paycheck calculator below allows employees to see how these changes affect pay and withholding. Determine if state income tax and other state and local taxes and withholdings apply.

moonladeg Blog, It is a simple yet tricky formula, to calculate your annual net income “multiply the gross pay (before tax deductions) by the number of pay periods. Use the irs tax withholding estimator to make sure you have the right.

California state taxes are calculated based on a progressive income tax rate, with higher earners paying a higher percentage.