What Is Vat In Ireland 2025

What Is Vat In Ireland 2025. Minister mcgrath welcomes revenue’s launch of public consultation on vat modernisation. Queen’s welcomes taoiseach on first official visit to northern ireland since taking office 3 may, 2025.

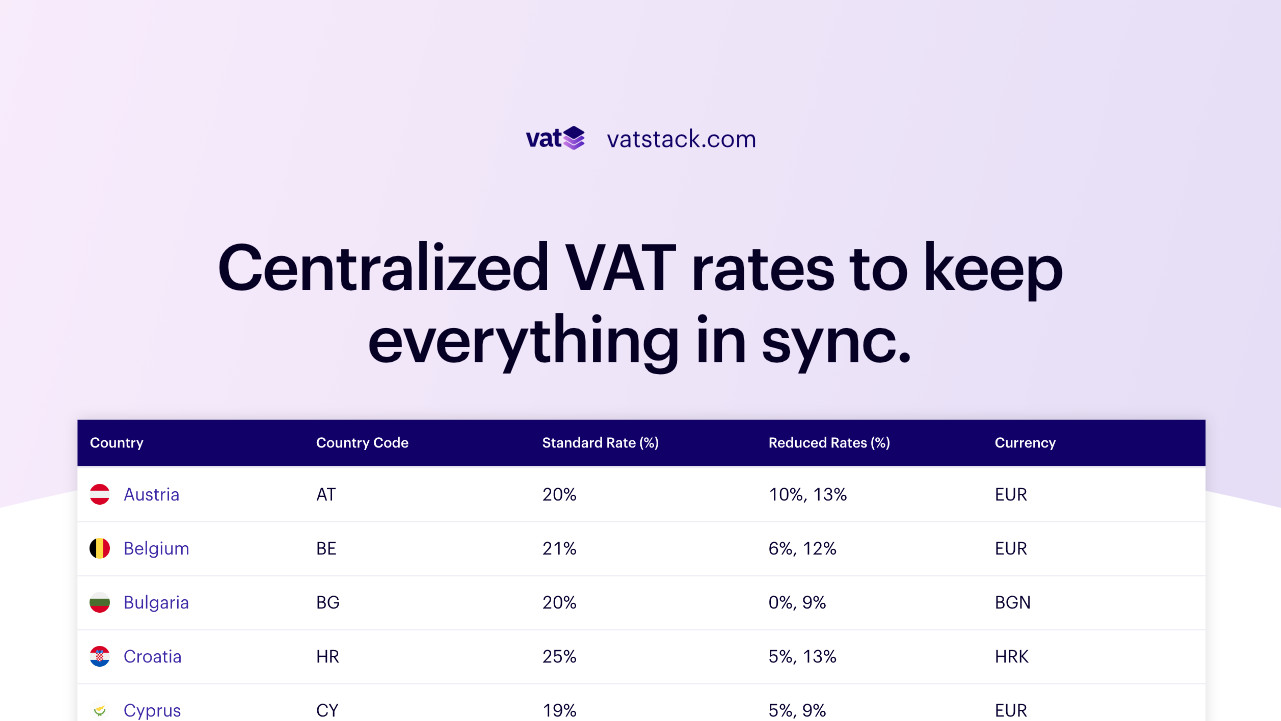

VAT Rates in Ireland Vatstack, The rate of irish vat which applies to certain goods and services, mainly in the tourism and hospitality sector, will increase from 9%. Minister mcgrath welcomes revenue’s launch of public consultation on vat modernisation.

VAT in Ireland What you should know — Lalor and Company, €40,000 in the case of persons supplying. As your vat accounting period ends on 31 december 2025:

VAT Explained Ireland Right Solution Centre, Vat compliance and reporting rules in ireland 2025. Readers should note that there are also numerous updates to vat.

VAT Calculator Ireland September 2025 Standard Rate is 23, If you are running a business in namibia, it’s important to. The irish minister for finance has announced on 10 october 2025 the opening of a public consultation on.

How do I get a VAT number in Ireland? First Accounts Ireland, 8 rows current vat rates; The standard rates for the vat calculation in ireland is 23% and we have also three reduced rates which are13,5%, 9%, 4,9% and 0%.

VAT Return Get hands on help with your VAT, Last updated on 7 december. In 2025, the vat registration in ireland is supervised by the irish revenue.

Irish Standard VAT Rate to Revert to 23 Following Temporary Decrease., Vat compliance and reporting rules in ireland 2025. These are the main changes on vat rates applicable from january 2025:

What is a VAT?, We have compiled the latest updates to various hmrc vat publications, briefs, and guidance. As your vat accounting period ends on 31 december 2025:

Importing goods into Ireland from EU and NonEU Countries, how VAT is, Companies and natural persons required to register for vat in this country can. Now you can calculate tax with our vat calculator namibia.

Submit your VAT return online FreeAgent, Public consultation extended by revenue commissioners. If you are running a business in namibia, it’s important to.